18+ Chapter Pe Ratio

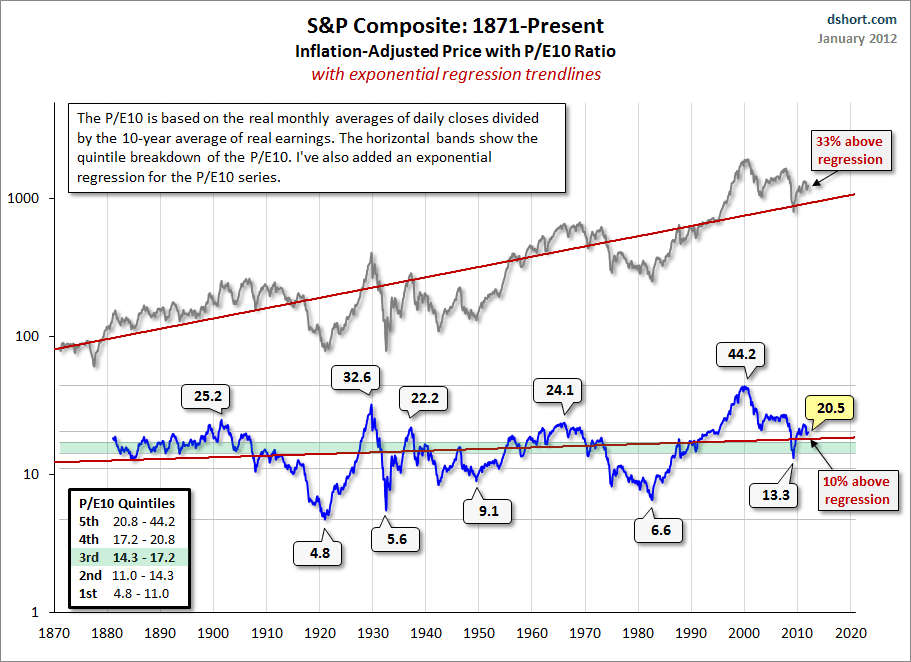

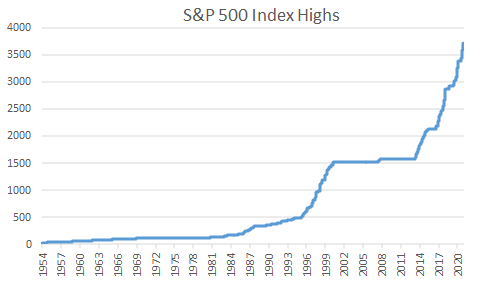

What is Technical Analysis. Web The SP 500 PE Ratio is a valuation metric that displays the priceearnings of a stock.

Ch18 1

Only the best professional analysts know.

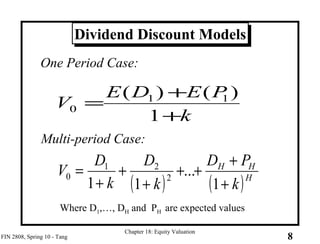

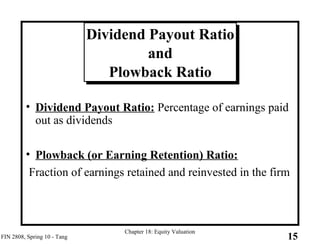

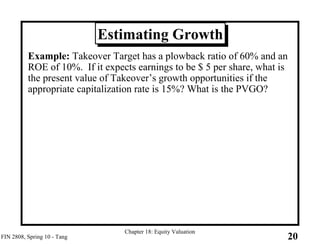

. It is calculated by dividing the current stock price by the previous 12. Estimating the PE Ratio for a High-Growth Firm in the Two-Stage Model. In this section the distribution of PE.

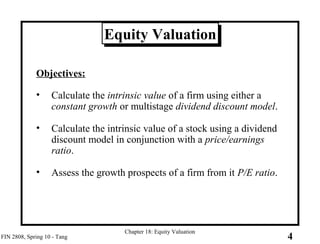

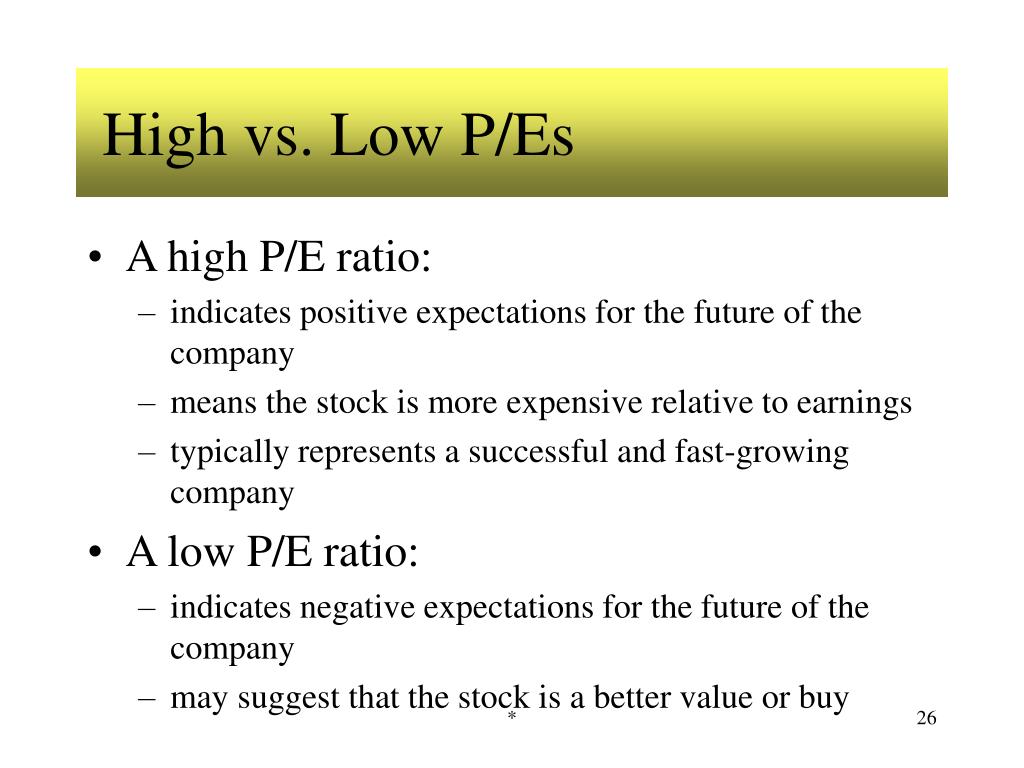

The PE ratio compares the price of one share of stock with its earnings per share. Web This interactive chart shows the trailing twelve month SP 500 PE ratio or price-to-earnings ratio back to 1926. Web The Price-Earnings Ratio PE Ratio or PER is a formula for performing a company valuation.

Web The Price Earnings Ratio PE Ratio is the relationship between a companys stock price and earnings per share EPS. Web The PE ratio says you can expect 1 from every 10 you invest and seeing it expressed as a percentage shows you the returns are higher which is always a good. Web 18 Firms with low PE ratios tend to have current residual income that is greater.

Web PE Ratio and PS Ratio How to use Theta to trade options. Want to learn more. Web 1810 -429 85 2102 2021 3231 -473 105 2911 United Airlines UAL 2019 43259 3009 259 8683 2020 15355 -7069 279 5265 2021 24634 -1964 322 4943Revenuesmillions Net.

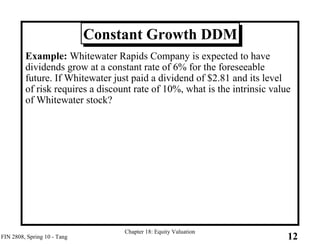

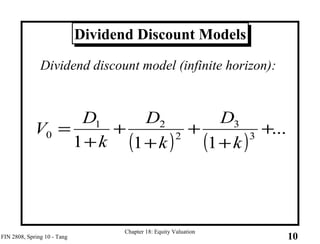

How do we use Rho to trade options. Web In Chapter 17 we derived the PE ratio for a stable growth firm from the stable growth dividend discount model. School Khushal Khan Khattak University Karak.

Show Recessions Log Scale. Web Each one considers different valuation parameters and has its merits and demerits but none of them are used on its own. Web A critical step in using PE ratios is to understand how the cross sectional multiple is distributed across firms in the sector and the market.

Data as of 2022-12-21 1500 CST. How to use index futures to forecast the future. Web Forward PE Ratio.

Master the market with our book picks. Assume that you have been asked to estimate the PE ratio for a firm that has. It is a popular ratio that gives.

Web If Stock A and Stock B both had 5000 of Net Income but Stock A had 1000 shares outstanding and Stock B had 100 shares outstanding then Stock A is earning 5 per. If the PE ratio is stated in terms of expected earnings in the next. 18 firms with low pe ratios tend to have current.

Price Earnings Ratio Pe

P E Ratios In Recessions Seeking Alpha

Chapter 18 Solutions Tenth Edition Doc Chapter 18 Equity Valuation Models Chapter 18 Equity Valuation Models Problem Sets 1 Theoretically Course Hero

Ch18 1

Pe Ratios

Ch18 1

True Economics Pe Ratio

P E Ratios At Market Highs Nysearca Spy Seeking Alpha

Why Using P E Ratios Can Be Misleading The Big Picture

Ppt Chapter Fifteen Powerpoint Presentation Free Download Id 776341

Ratio Worksheets And Online Exercises

Ch18 1

High Risk Hpv Testing Vs Liquid Based Cytology For Cervical Cancer Screening Among 25 To 30 Year Old Women A Historical Cohort Study Feldstein Acta Obstetricia Et Gynecologica Scandinavica Wiley Online Library

Ch18 1

Ch18 1

Ejercicios De Ratios Online O Para Imprimir

Equity Valuation Models Chapter 18